Well it seems that Israel has figured out a way to defang Iran... and to simultaneously free the world from the 'oil dictatorship' of Saudi Arabia, Venezuela, and other oil-producing nations! How you ask? Well, Israel's Infrastructure Minister Uzi Landau has a master plan - "... in October 2009 Israeli PM Netanyahu launched a "national project" at Israel's National Economic Council to find a way to end the world's dependence on fossil fuels ..." So, Israel will develop the green technologies that will end the industrialized nations' dependence on fossil fuels, which will de-fund these regimes...

After a fit of hilarity (that really hurt) this blogger checked the date on the article and googled to find this story elsewhere. He found numerous references, none of them dated April the first! So, apparently this is "real". One wonders what Landau has been drinking....

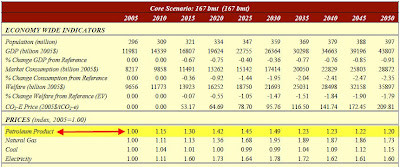

Maybe it was something in the water, because the very next day another article suggested that a cap on carbon in the U.S. would be a good thing because the reduction in oil consumption would significantly hurt Iran by putting a crimp into its flow of petrodollars. It was accompanied by the graph below...

After a fit of hilarity (that really hurt) this blogger checked the date on the article and googled to find this story elsewhere. He found numerous references, none of them dated April the first! So, apparently this is "real". One wonders what Landau has been drinking....

Maybe it was something in the water, because the very next day another article suggested that a cap on carbon in the U.S. would be a good thing because the reduction in oil consumption would significantly hurt Iran by putting a crimp into its flow of petrodollars. It was accompanied by the graph below...

Wow, this really looks like a very serious reduction, assuming of course that the U.S. can (or will) actually reduce its emissions to get to the "167 case." However, the graph seems to imply much more than the reality... after a cursory glance one might infer that from 2010 to 20150 Iran's oil revenues would crater by approximately 90%. However, looking at the 'Core Scenario 167 bmt' on page 69 one sees that the price index for petroleum products in 2050 would be 1.20, or slightly higher than the price index for 2010 (at 1.15)

Wow, this really looks like a very serious reduction, assuming of course that the U.S. can (or will) actually reduce its emissions to get to the "167 case." However, the graph seems to imply much more than the reality... after a cursory glance one might infer that from 2010 to 20150 Iran's oil revenues would crater by approximately 90%. However, looking at the 'Core Scenario 167 bmt' on page 69 one sees that the price index for petroleum products in 2050 would be 1.20, or slightly higher than the price index for 2010 (at 1.15)Using the index numbers from the MIT Assessment of U.S. Cap-and-Trade Proposals, this blogger graphed out the two cases - the baseline "reference case" if nothing is done, and the "167 case." If the assumption is made that Iran's production remains at 4.174 million barrels per day (as in the article), and that the 2010 price starts out at $83 a barrel you get the graph below:

Iran will "lose" the revenue between the two lines, or the area in red... Indeed a serious hit but no where near as drastic as is implied by the article's graph. Anyway, there are better reasons for the U.S. to cap its greenhouse gas emissions than a putative crimp in Iran's oil revenue...

Iran will "lose" the revenue between the two lines, or the area in red... Indeed a serious hit but no where near as drastic as is implied by the article's graph. Anyway, there are better reasons for the U.S. to cap its greenhouse gas emissions than a putative crimp in Iran's oil revenue...

No comments:

Post a Comment